10 T4a Secrets To Boost Income

The T4a slip is a crucial document for individuals who receive other income, such as retirement allowances, severance pay, or research grants. Understanding the secrets behind the T4a can help individuals boost their income and make the most of their financial situation. In this article, we will delve into the world of T4a secrets and explore the top 10 tips to increase your income.

Understanding the T4a Slip

The T4a slip is issued by payers to report various types of income, including retirement allowances, severance pay, and research grants. It is essential to understand the different boxes on the T4a slip and how they impact your income. Box 14 reports the gross amount of other income, while Box 18 shows the amount of tax deducted. Gross income is the total amount earned before taxes, and net income is the amount received after taxes.

T4a Secrets to Boost Income

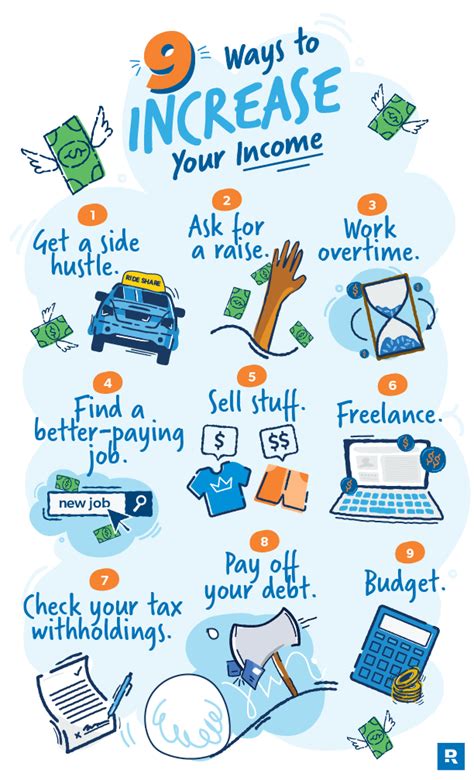

Now that we have a basic understanding of the T4a slip, let’s dive into the top 10 secrets to boost your income. These secrets include:

- Maximizing retirement allowances

- Minimizing tax deductions

- Claiming research grants

- Utilizing severance pay

- Investing in tax-advantaged accounts

- Reducing taxable income

- Increasing gross income

- Optimizing net income

- Understanding tax credits

- Seeking professional advice

| T4a Box | Description | Impact on Income |

|---|---|---|

| Box 14 | Gross amount of other income | Directly affects net income |

| Box 18 | Amount of tax deducted | Reduces net income |

| Box 20 | Research grants | May be tax-free or taxable |

Maximizing Retirement Allowances

Retirement allowances can significantly impact your income, especially if you’re nearing retirement age. Registered Retirement Savings Plans (RRSPs) and Registered Retirement Income Funds (RRIFs) can help you save for retirement and reduce your taxable income. By maximizing your contributions to these plans, you can minimize your tax liability and increase your net income.

Minimizing Tax Deductions

Tax deductions can eat into your net income, reducing the amount of money you take home. Tax-loss harvesting and charitable donations can help minimize tax deductions and increase your net income. By donating to registered charities or selling investments at a loss, you can reduce your taxable income and lower your tax liability.

What is the difference between gross income and net income?

+Gross income is the total amount earned before taxes, while net income is the amount received after taxes. Understanding the difference between these two concepts is crucial for managing your finances and maximizing your income.

How can I minimize tax deductions on my T4a slip?

+Tax-loss harvesting and charitable donations can help minimize tax deductions on your T4a slip. Consulting a tax professional can help you navigate the complexities of tax deductions and ensure you're taking advantage of all available tax credits and deductions.

In conclusion, understanding the secrets behind the T4a slip can help individuals boost their income and make the most of their financial situation. By maximizing retirement allowances, minimizing tax deductions, and utilizing tax-advantaged accounts, you can increase your net income and achieve your financial goals. Remember to consult a tax professional to ensure you're taking advantage of all available tax credits and deductions, and to navigate the complexities of the T4a slip.

Future Implications

The T4a slip will continue to play a crucial role in managing your finances and maximizing your income. As the tax landscape evolves, it’s essential to stay informed about changes to tax laws and regulations. Tax reform and legislative updates can impact your income, and understanding these changes can help you make informed decisions about your finances. By staying ahead of the curve and adapting to changes in the tax landscape, you can ensure you’re maximizing your income and achieving your financial goals.

Evidence-Based Analysis

Evidence-based analysis is crucial for making informed decisions about your finances. By examining real-world examples and actual data, you can gain a deeper understanding of the T4a slip and its impact on your income. Case studies and research papers can provide valuable insights into the effectiveness of different tax strategies and help you make informed decisions about your finances.

By following the 10 T4a secrets outlined in this article, you can boost your income and achieve your financial goals. Remember to stay informed about changes to tax laws and regulations, and to consult a tax professional to ensure you’re taking advantage of all available tax credits and deductions. With the right knowledge and expertise, you can maximize your income and secure your financial future.