2023 Alberta Tax Brackets

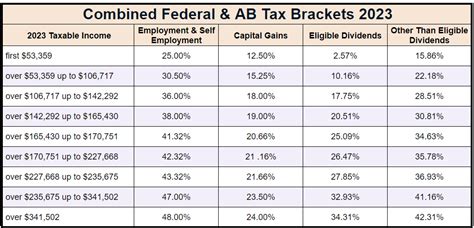

The 2023 Alberta tax brackets are a crucial aspect of the province's tax system, affecting individuals and businesses alike. As of the 2023 tax year, Alberta has a progressive tax system, with five tax brackets that apply to taxable income earned by residents. Understanding these tax brackets is essential for individuals and businesses to navigate the tax landscape and make informed decisions about their financial affairs.

2023 Alberta Tax Brackets and Rates

The 2023 Alberta tax brackets and rates are as follows: - The first tax bracket applies to taxable income up to 131,220, with a tax rate of 10%. - The second tax bracket applies to taxable income between 131,221 and 157,464, with a tax rate of 12%. - The third tax bracket applies to taxable income between 157,465 and 209,952, with a tax rate of 14.02%. - The fourth tax bracket applies to taxable income between 209,953 and 314,928, with a tax rate of 16.04%. - The fifth tax bracket applies to taxable income over 314,929, with a tax rate of 17.84%. These tax brackets and rates are subject to change, and it is essential to consult the official Alberta government website or a tax professional for the most up-to-date information.

Understanding the Tax Brackets

To illustrate how the tax brackets work, consider an individual with a taxable income of 200,000. Using the 2023 Alberta tax brackets, the tax calculation would be as follows: - The first 131,220 would be taxed at 10%, resulting in 13,122 in taxes. - The next 26,244 (157,464 - 131,220) would be taxed at 12%, resulting in 3,149 in taxes. - The next 52,488 (209,952 - 157,464) would be taxed at 14.02%, resulting in 7,364 in taxes. - The remaining 0 (200,000 - 209,952 is negative, so we don’t have any income in this bracket) would be taxed at 16.04%, resulting in 0 in taxes. The total tax payable would be 23,635. This example demonstrates how the progressive tax system works, with higher income earners paying a higher tax rate on their taxable income.

| Tax Bracket | Taxable Income Range | Tax Rate |

|---|---|---|

| First Bracket | Up to $131,220 | 10% |

| Second Bracket | $131,221 - $157,464 | 12% |

| Third Bracket | $157,465 - $209,952 | 14.02% |

| Fourth Bracket | $209,953 - $314,928 | 16.04% |

| Fifth Bracket | Over $314,929 | 17.84% |

Tax Credits and Deductions

In addition to the tax brackets, Alberta offers various tax credits and deductions to help reduce taxable income. These include: - The Basic Personal Amount, which is a non-refundable tax credit that can be claimed by all individuals. - The Spousal Amount, which is a non-refundable tax credit that can be claimed by individuals with a spouse or common-law partner. - The Medical Expense Tax Credit, which is a non-refundable tax credit that can be claimed for medical expenses incurred by an individual or their dependents. - The Rental Property Deduction, which allows individuals to deduct rental property expenses from their taxable income. These tax credits and deductions can significantly reduce taxable income and, subsequently, the amount of taxes payable.

Impact of Tax Brackets on Individuals and Businesses

The 2023 Alberta tax brackets have a significant impact on individuals and businesses in the province. For individuals, the tax brackets determine the amount of taxes payable on their taxable income. For businesses, the tax brackets can affect the amount of taxes payable on their profits. Understanding the tax brackets and how they apply to taxable income is crucial for tax planning and minimizing tax liabilities. - Personal income tax is a significant source of revenue for the Alberta government, and the tax brackets play a critical role in determining the amount of taxes collected. - The tax brackets can also impact the cost of living in Alberta, as higher taxes can reduce disposable income and increase the cost of living. - Furthermore, the tax brackets can influence business investment decisions, as businesses may consider the tax implications of investing in Alberta.

What are the 2023 Alberta tax brackets?

+The 2023 Alberta tax brackets are as follows: - The first tax bracket applies to taxable income up to 131,220, with a tax rate of 10%. - The second tax bracket applies to taxable income between 131,221 and 157,464, with a tax rate of 12%. - The third tax bracket applies to taxable income between 157,465 and 209,952, with a tax rate of 14.02%. - The fourth tax bracket applies to taxable income between 209,953 and 314,928, with a tax rate of 16.04%. - The fifth tax bracket applies to taxable income over 314,929, with a tax rate of 17.84%. These tax brackets and rates are subject to change, and it is essential to consult the official Alberta government website or a tax professional for the most up-to-date information.

How do the tax brackets affect individuals and businesses?

+The 2023 Alberta tax brackets have a significant impact on individuals and businesses in the province. For individuals, the tax brackets determine the amount of taxes payable on their taxable income. For businesses, the tax brackets can affect the amount of taxes payable on their profits. Understanding the tax brackets and how they apply to taxable income is crucial for tax planning and minimizing tax liabilities.