7 Mclean Anderson Secrets To Gain Edge

The world of finance and investing is highly competitive, and gaining an edge is crucial for success. Mclean Anderson, a renowned expert in the field, has shared his secrets to gaining an edge in the market. With years of experience and a proven track record, Anderson's insights are invaluable for investors and financial professionals alike. In this article, we will delve into the 7 Mclean Anderson secrets to gain an edge, providing a comprehensive understanding of each concept and its application in the real world.

Understanding the Market

Anderson’s first secret to gaining an edge is to have a deep understanding of the market. This involves conducting thorough research and staying up-to-date with the latest trends and developments. By analyzing market data and identifying patterns, investors can make informed decisions and stay ahead of the curve. Anderson emphasizes the importance of staying adaptable and being able to adjust to changing market conditions. This requires a combination of technical skills, such as data analysis, and soft skills, such as critical thinking and problem-solving.

Market Analysis Techniques

Anderson recommends using a variety of market analysis techniques, including technical analysis and fundamental analysis. Technical analysis involves studying charts and patterns to predict future price movements, while fundamental analysis involves examining a company’s financial statements and other data to determine its value. By combining these approaches, investors can gain a more comprehensive understanding of the market and make more informed decisions. For example, Anderson suggests using moving averages to identify trends and relative strength index (RSI) to gauge market sentiment.

| Analysis Technique | Description |

|---|---|

| Technical Analysis | Study of charts and patterns to predict future price movements |

| Fundamental Analysis | Examination of a company's financial statements and other data to determine its value |

| Quantitative Analysis | Use of mathematical models and statistical techniques to analyze market data |

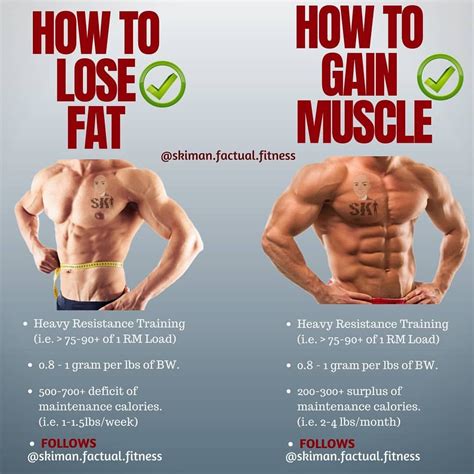

Diversification and Risk Management

Anderson’s second secret to gaining an edge is to diversify your portfolio and manage risk effectively. This involves spreading investments across different asset classes and hedges to minimize exposure to any one particular market or sector. By diversifying your portfolio, you can reduce your risk and increase your potential returns. Anderson recommends using a variety of risk management techniques, including stop-loss orders and position sizing. For example, he suggests allocating 60% of your portfolio to low-risk investments, such as bonds, and 40% to higher-risk investments, such as stocks.

Risk Management Strategies

Anderson emphasizes the importance of having a well-thought-out risk management plan in place. This involves identifying potential risks and taking steps to mitigate them. By hedging your bets and diversifying your portfolio, you can reduce your exposure to market volatility and protect your investments. Anderson recommends using a variety of risk management strategies, including options trading and futures contracts. For example, he suggests using call options to hedge against potential losses in a declining market.

- Stop-loss orders: automatically sell a security when it falls below a certain price

- Position sizing: allocate a specific amount of capital to each trade based on its potential risk and return

- Hedging: reduce exposure to market volatility by taking opposing positions in related securities

Staying Disciplined and Patient

Anderson’s third secret to gaining an edge is to stay disciplined and patient. This involves sticking to your investment plan and avoiding emotional decisions. By remaining calm and focused, you can avoid making impulsive decisions that can hurt your investments. Anderson recommends using a variety of techniques to stay disciplined, including setting clear goals and establishing a routine. For example, he suggests setting a long-term investment horizon and avoiding short-term market fluctuations.

Investment Psychology

Anderson emphasizes the importance of understanding investment psychology and how it can impact your decision-making. By recognizing your biases and managing your emotions, you can make more informed decisions and avoid common pitfalls. Anderson recommends using a variety of techniques to manage your emotions, including meditation and journaling. For example, he suggests writing down your investment goals and tracking your progress to stay motivated and focused.

Continuous Learning and Improvement

Anderson’s fourth secret to gaining an edge is to continuously learn and improve. This involves staying up-to-date with the latest trends and developments and expanding your knowledge and skills. By reading books and articles and attending seminars and workshops, you can stay ahead of the curve and make more informed decisions. Anderson recommends using a variety of resources to learn and improve, including online courses and mentoring programs. For example, he suggests reading The Wall Street Journal and Forbes to stay informed about market trends and developments.

Learning and Development Strategies

Anderson emphasizes the importance of having a well-thought-out learning and development plan in place. This involves identifying areas for improvement and taking steps to address them. By setting clear goals and establishing a routine, you can stay focused and motivated and achieve your learning and development objectives. Anderson recommends using a variety of strategies to learn and improve, including reflection and self-assessment. For example, he suggests setting aside time each week to reflect on your progress and identify areas for improvement.

- Set clear goals: identify what you want to learn and achieve

- Establish a routine: set aside time each week to learn and improve

- Reflect and self-assess: regularly evaluate your progress and identify areas for improvement

Networking and Building Relationships

Anderson’s fifth secret to gaining an edge is to network and build relationships. This involves connecting with other investors and financial professionals and building a network of contacts. By attending industry events and joining online communities, you can stay informed about market trends and developments and gain valuable insights and advice. Anderson recommends using a variety of strategies to network and build relationships, including volunteering and mentoring. For example, he suggests attending industry conferences and joining online forums to connect with other investors and financial professionals.

Networking Strategies

Anderson emphasizes the importance of having a well-thought-out networking plan in place. This involves identifying potential contacts and taking steps to connect with them. By being proactive and following up, you can build a strong network of contacts and gain valuable insights and advice. Anderson recommends using a variety of strategies to network, including email marketing and social media. For example, he suggests using LinkedIn to connect with other investors and financial professionals and Twitter to stay informed about market trends and developments.

Staying Flexible and Adaptable

Anderson’s sixth secret to gaining an edge is to stay flexible and adaptable. This involves being open to new ideas and approaches and being willing to adjust your strategy. By staying agile and being responsive to change, you can stay ahead of the curve and make more informed decisions. Anderson recommends