Alberta Corporate Tax Rates

The province of Alberta, located in western Canada, has a unique set of corporate tax rates that are designed to attract businesses and stimulate economic growth. As of the latest available data, Alberta's corporate tax rates are among the most competitive in Canada. In this article, we will delve into the details of Alberta's corporate tax rates, exploring the different types of taxes, rates, and exemptions that apply to businesses operating in the province.

Overview of Alberta Corporate Tax Rates

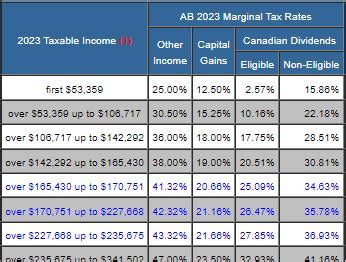

Alberta’s corporate tax system is based on a tiered structure, with different tax rates applying to different levels of taxable income. The general corporate tax rate in Alberta is 8%, which is one of the lowest in Canada. However, this rate only applies to taxable income up to 500,000. For taxable income above 500,000, the federal corporate tax rate of 15% applies, in addition to the Alberta general corporate tax rate. This means that the combined federal and provincial corporate tax rate for large corporations in Alberta is 23%.

Small Business Tax Rate

Alberta has a special tax rate for small businesses, known as the small business tax rate. This rate applies to taxable income up to 500,000 and is set at 2%. This means that small businesses in Alberta pay a combined federal and provincial tax rate of 12% on their taxable income up to 500,000. The small business tax rate is designed to help small businesses and startups by reducing their tax burden and allowing them to retain more of their earnings.

| Taxable Income | Alberta General Corporate Tax Rate | Small Business Tax Rate |

|---|---|---|

| Up to $500,000 | 8% | 2% |

| Above $500,000 | 8% + 15% (federal rate) | N/A |

Other Tax Rates and Exemptions

In addition to the general corporate tax rate and small business tax rate, there are other tax rates and exemptions that apply to businesses in Alberta. For example, the province has a special tax rate for credit unions, which is set at 10%. There are also exemptions for certain types of income, such as income from farming and fishing operations. Furthermore, Alberta has a tax credit program for businesses that invest in research and development, which can help reduce their tax liability.

It's also worth noting that Alberta has a number of tax incentives and programs designed to attract businesses to the province. For example, the Alberta Investment Tax Credit (AITC) provides a tax credit of up to 10% of eligible investment costs for businesses that invest in the province. The AITC is designed to help businesses offset the costs of investing in Alberta and can be claimed in addition to other tax credits and deductions.

Comparison with Other Provinces

Alberta’s corporate tax rates are competitive with other provinces in Canada. For example, the general corporate tax rate in British Columbia is 12%, while the rate in Ontario is 11.5%. However, Alberta’s small business tax rate is one of the lowest in the country, making it an attractive location for small businesses and startups.

| Province | General Corporate Tax Rate | Small Business Tax Rate |

|---|---|---|

| Alberta | 8% | 2% |

| British Columbia | 12% | 2.5% |

| Ontario | 11.5% | 3.2% |

Future Implications

The future of Alberta’s corporate tax rates is uncertain, as the province’s government has announced plans to review and potentially reform the tax system. However, any changes to the tax system are likely to be designed to maintain Alberta’s competitiveness and attractiveness to businesses. In the meantime, businesses can take advantage of the province’s low corporate tax rates and other incentives to invest and grow in Alberta.

What is the general corporate tax rate in Alberta?

+The general corporate tax rate in Alberta is 8%, which applies to taxable income up to 500,000. For taxable income above 500,000, the federal corporate tax rate of 15% applies, in addition to the Alberta general corporate tax rate.

What is the small business tax rate in Alberta?

+The small business tax rate in Alberta is 2%, which applies to taxable income up to $500,000. This rate is designed to help small businesses and startups by reducing their tax burden and allowing them to retain more of their earnings.

Are there any tax incentives or programs available for businesses in Alberta?

+Yes, there are several tax incentives and programs available for businesses in Alberta, including the Alberta Investment Tax Credit (AITC) and the research and development tax credit program. These programs are designed to help businesses offset the costs of investing in Alberta and can be claimed in addition to other tax credits and deductions.