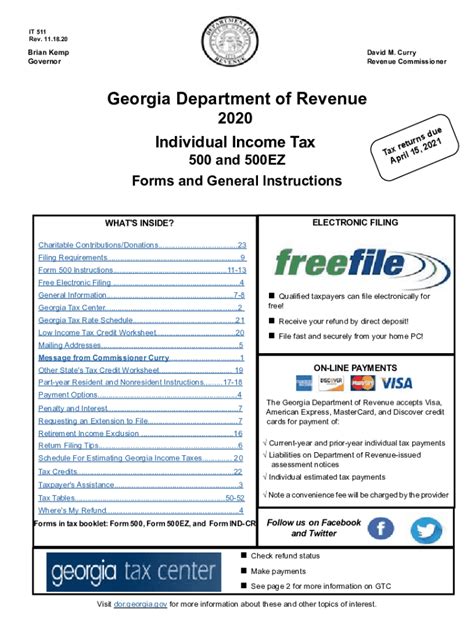

Complete Tax Guide: Ga Income Tax Returns Simplified

The state of Georgia has a complex tax system, but understanding the basics can help simplify the process of filing your income tax returns. As a resident of Georgia, it's essential to be aware of the various tax laws and regulations that apply to your specific situation. In this comprehensive guide, we'll delve into the world of Georgia income tax returns, covering topics such as tax rates, deductions, and credits.

Georgia Income Tax Rates

Georgia has a progressive income tax system, with six tax brackets ranging from 1% to 5.99%. The tax rates are as follows:

| Taxable Income | Tax Rate |

|---|---|

| 0 - 750 | 1% |

| 751 - 2,250 | 2% |

| 2,251 - 3,750 | 3% |

| 3,751 - 5,250 | 4% |

| 5,251 - 7,000 | 5% |

| $7,001 and above | 5.99% |

It’s essential to note that these tax rates are subject to change, and it’s always a good idea to check with the Georgia Department of Revenue for the most up-to-date information.

Deductions and Exemptions

Georgia allows several deductions and exemptions that can help reduce your taxable income. Some of the most common deductions include:

- Standard Deduction: The standard deduction for single filers is 4,600, while joint filers can claim 6,000.

- Itemized Deductions: You can itemize deductions such as mortgage interest, property taxes, and charitable contributions.

- Personal Exemptions: You can claim a personal exemption of $2,300 for yourself, your spouse, and each dependent.

Tax Credits

Georgia offers various tax credits that can help reduce your tax liability. Some of the most common tax credits include:

- Earned Income Tax Credit (EITC): This credit is designed for low-income working individuals and families.

- Child Tax Credit: You can claim a credit of up to $2,000 per child, depending on your income level.

- Education Tax Credits: You can claim a credit for education expenses, such as tuition and fees.

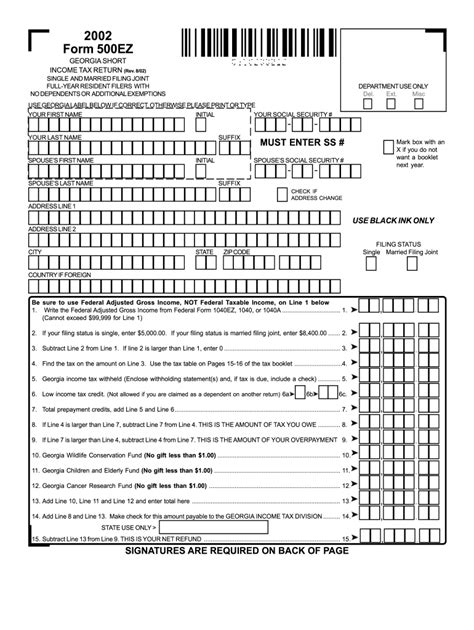

Tax Filing Requirements

In Georgia, you’re required to file a tax return if your gross income meets certain thresholds. The filing requirements are as follows:

- Single Filers: You must file a tax return if your gross income is 9,750 or more.</li> <li><strong>Joint Filers</strong>: You must file a tax return if your combined gross income is 19,500 or more.

- Head of Household Filers: You must file a tax return if your gross income is $14,200 or more.

Electronic Filing and Payment Options

The Georgia Department of Revenue offers various electronic filing and payment options, making it easier and more convenient to file your tax return. You can:

- E-file your tax return: You can e-file your tax return through the Georgia Tax Center or through a tax professional.

- Make online payments: You can make online payments using a credit or debit card, or through an electronic funds transfer.

- Set up a payment plan: If you’re unable to pay your tax liability in full, you can set up a payment plan with the Georgia Department of Revenue.

Tax Audit and Appeals Process

If you’re selected for a tax audit, it’s essential to understand the process and your rights as a taxpayer. You can:

- Respond to the audit notice: You’ll receive a notice from the Georgia Department of Revenue, and you must respond within the specified timeframe.

- Provide documentation and records: You’ll need to provide supporting documentation and records to substantiate your tax return.

- Appeal the audit decision: If you disagree with the audit decision, you can appeal to the Georgia Tax Tribunal.

What is the deadline for filing my Georgia income tax return?

+

The deadline for filing your Georgia income tax return is typically April 15th, but it may be extended in certain circumstances. It’s essential to check with the Georgia Department of Revenue for the most up-to-date information.

How do I check the status of my tax refund?

+

You can check the status of your tax refund by visiting the Georgia Tax Center website or by calling the Georgia Department of Revenue’s customer service number.

What are the penalties for not filing my tax return on time?

+

The penalties for not filing your tax return on time can include late filing fees, interest on the unpaid tax liability, and potential audit or collection actions. It’s essential to file your tax return on time to avoid these penalties.