Economic Analysis: Comprehensive Review Of Corporate Tax Implementation

The implementation of corporate tax has been a cornerstone of economic policy in many countries, aiming to balance the need for revenue generation with the encouragement of business growth and investment. A comprehensive review of corporate tax implementation is essential to understand its impact on economies, businesses, and individuals. This article provides an in-depth analysis of the economic effects of corporate tax, its historical development, current trends, and future implications.

Introduction to Corporate Tax

Corporate tax, also known as corporation tax, is a type of tax levied on the profits made by companies. The tax rate and base vary significantly across different countries, reflecting each nation’s economic policies and priorities. The primary goal of corporate tax is to generate revenue for governments, which can then be used to fund public services and infrastructure. However, corporate tax also plays a critical role in shaping business decisions, influencing investment patterns, and affecting economic growth.

Historical Development of Corporate Tax

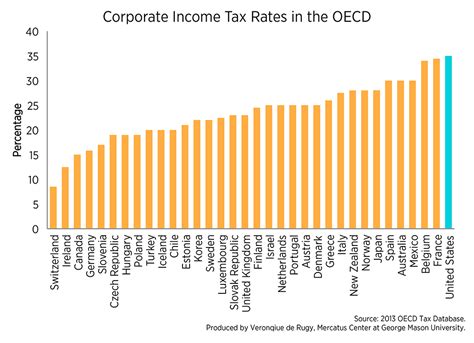

The concept of corporate tax has its roots in the late 19th and early 20th centuries, when governments began to recognize the need to tax corporate profits. In the United States, for example, the first federal corporate tax was introduced in 1909, with a tax rate of 1% on corporate profits. Over the years, corporate tax rates have fluctuated, with significant changes in the 1980s, which saw a reduction in tax rates in many countries, including the United States and the United Kingdom. Globalization and the increasing mobility of capital have also led to a greater focus on international tax cooperation and the prevention of tax evasion.

| Country | Corporate Tax Rate (2022) |

|---|---|

| United States | 21% |

| United Kingdom | 19% |

| Germany | 15% (plus 5.5% solidarity surcharge) |

| Australia | 30% |

Economic Effects of Corporate Tax

The economic effects of corporate tax are complex and multifaceted. On one hand, corporate tax can generate significant revenue for governments, which can be used to fund essential public services and infrastructure. On the other hand, high corporate tax rates can discourage investment, reduce employment, and lead to lower economic growth. The impact of corporate tax on businesses and individuals can also vary significantly, depending on factors such as the tax rate, the tax base, and the availability of tax deductions and credits.

Impact on Business Investment and Employment

Corporate tax can influence business investment decisions, with high tax rates potentially discouraging investment in certain sectors or regions. A study by the OECD found that a 1% reduction in the corporate tax rate can lead to a 0.5% to 1% increase in business investment. Additionally, corporate tax can affect employment levels, as businesses may respond to high tax rates by reducing their workforce or relocating to lower-tax jurisdictions. Empirical evidence suggests that the impact of corporate tax on employment is generally smaller than its impact on investment.

The economic effects of corporate tax can also vary across different industries and sectors. For example, the technology sector is often characterized by high research and development (R&D) expenditures, which can be affected by corporate tax policies. In contrast, the manufacturing sector may be more sensitive to changes in corporate tax rates, due to its higher capital intensity and lower profit margins.

- Reduced investment in R&D and innovation

- Lower employment levels and reduced economic growth

- Increased tax evasion and avoidance activities

- Reduced government revenue and increased budget deficits

Current Trends and Future Implications

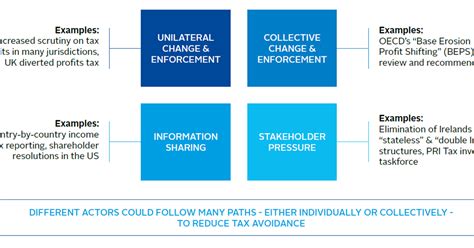

The current trends in corporate tax policy are characterized by a mix of tax rate reductions, base broadening, and increased international cooperation. The OECD’s Base Erosion and Profit Shifting (BEPS) project aims to address the challenges posed by globalization and the increasing mobility of capital, by promoting greater transparency, cooperation, and consistency in international tax policies. The future implications of these trends are significant, with potential effects on economic growth, investment, and employment.

Globalization and International Tax Cooperation

The increasing globalization of trade and investment has created new challenges for corporate tax policy, including the risk of base erosion and profit shifting. To address these challenges, governments and international organizations have launched initiatives to promote greater transparency, cooperation, and consistency in international tax policies. The OECD’s BEPS project is a key example of this effort, aiming to ensure that profits are taxed where economic activities generating the profits are performed and where value is created.

| Initiative | Description |

|---|---|

| OECD BEPS project | Aim to address base erosion and profit shifting by promoting greater transparency, cooperation, and consistency in international tax policies |

| EU Anti-Tax Avoidance Directive | Aim to prevent aggressive tax planning and ensure a fair and transparent tax environment in the EU |

| US Tax Cuts and Jobs Act | Aim to reduce the corporate tax rate, broaden the tax base, and promote economic growth and investment |

What is the main purpose of corporate tax?

+The main purpose of corporate tax is to generate revenue for governments, which can then be used to fund public services and infrastructure.

How does corporate tax affect business investment and employment?

+Corporate tax can influence business investment decisions, with high tax rates potentially discouraging investment in certain sectors or regions. Additionally, corporate tax can affect employment levels, as businesses may respond to high tax rates by reducing their workforce or relocating to lower-tax jurisdictions.

What are the current trends in corporate tax policy?

+The current trends in corporate tax policy are characterized by a mix of tax rate reductions, base broadening, and increased international cooperation. The OECD's Base Erosion and Profit Shifting (BEPS) project aims to address the challenges posed by globalization and the increasing mobility of capital, by promoting greater transparency, cooperation, and consistency in international tax policies.

In conclusion, the implementation of corporate tax has significant economic effects, influencing business investment, employment, and economic growth. The current trends in corporate tax policy, including tax rate reductions, base broadening, and increased international cooperation, have important implications for the future of corporate tax. As governments and international organizations continue to address the challenges posed by globalization and the increasing mobility of capital, it is essential to consider the impact of corporate tax on economic outcomes and to implement policies that promote investment, innovation, and employment.