Lif Withdrawal Rules Alberta: Know Your Options

When it comes to managing your savings and investments, understanding the rules and regulations surrounding withdrawals is crucial. In Alberta, Canada, the Lif Withdrawal Rules are an essential aspect of financial planning, particularly for those with Locked-In Funds (LIFs). A LIF is a type of registered retirement savings plan (RRSP) that is designed to provide a steady income stream in retirement. However, withdrawing from a LIF can be complex, and it's essential to know your options to make informed decisions about your financial future.

Understanding LIF Withdrawal Rules in Alberta

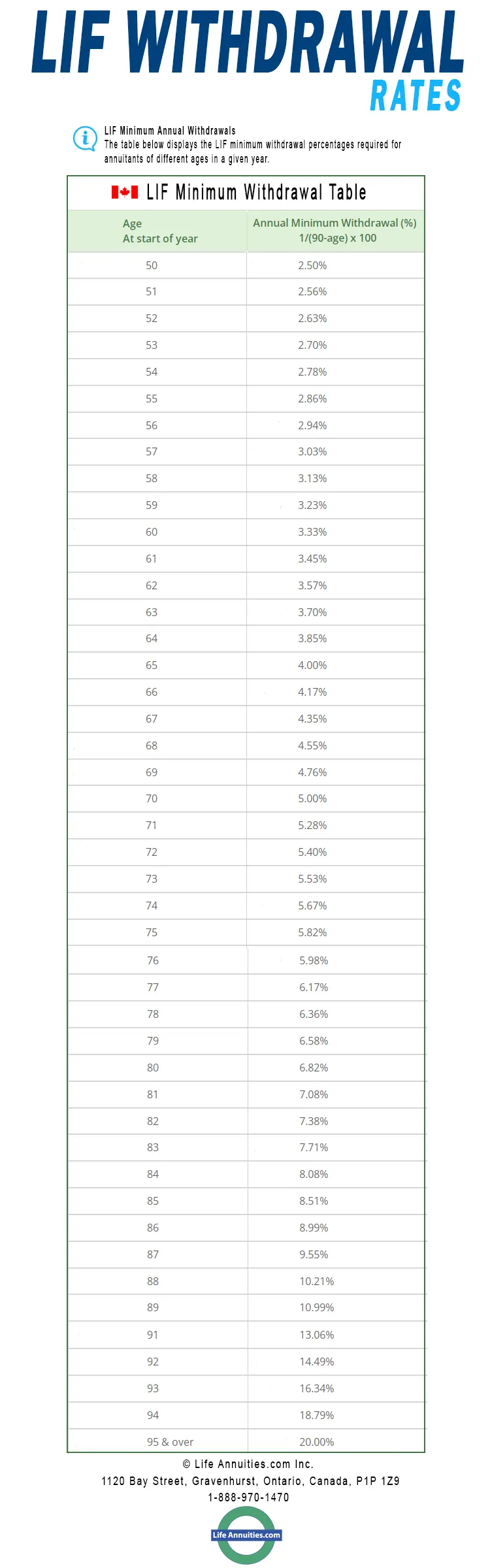

In Alberta, LIF withdrawal rules are governed by the Alberta Superintendent of Pensions. The rules are designed to ensure that LIF holders have a steady income stream in retirement while also providing flexibility in managing their funds. The minimum annual payment from a LIF is determined by a formula that takes into account the LIF holder’s age and the value of the LIF. The maximum annual payment is also subject to certain limits, which are designed to ensure that the LIF lasts for the holder’s lifetime.

Types of LIF Withdrawals in Alberta

There are several types of LIF withdrawals that are permitted in Alberta, including:

- Minimum Annual Payments: These are the minimum payments that must be made from a LIF each year. The amount is determined by the LIF holder’s age and the value of the LIF.

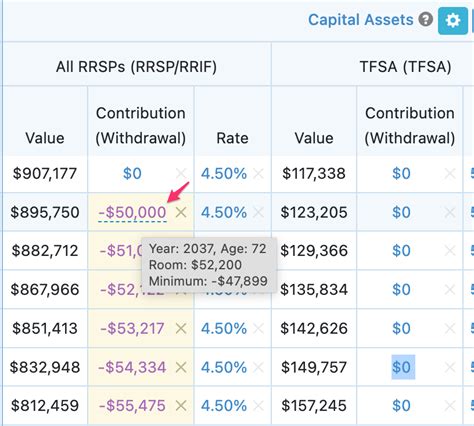

- Variable Payments: LIF holders can elect to receive variable payments, which can be higher or lower than the minimum annual payment, subject to certain limits.

- Lump-Sum Payments: In certain circumstances, LIF holders may be able to withdraw a lump sum from their LIF, subject to certain conditions and penalties.

It's essential to note that LIF withdrawals are subject to income tax, and LIF holders should consider the tax implications of their withdrawal options. Locked-In Retirement Accounts (LIRAs) and Life Income Funds (LIFs) are subject to similar rules and regulations.

| Age | Minimum Annual Payment |

|---|---|

| 55-60 | 4% of the LIF value |

| 61-65 | 4.5% of the LIF value |

| 66-70 | 5% of the LIF value |

| 71 and over | 5.5% of the LIF value |

Considerations for LIF Withdrawals in Alberta

When considering LIF withdrawals, there are several factors to take into account, including:

- Tax Implications: LIF withdrawals are subject to income tax, and the tax implications should be carefully considered.

- Investment Options: LIF holders should consider their investment options and how they may impact their withdrawal strategy.

- Income Needs: LIF holders should consider their income needs in retirement and how their LIF withdrawals will impact their overall financial situation.

It's also essential to consider the potential risks and benefits of different withdrawal strategies. For example, taking a lump-sum payment may provide a short-term cash influx, but it may also reduce the long-term sustainability of the LIF. Fee structures and investment management fees should also be carefully considered.

Seeking Professional Advice

Given the complexity of LIF withdrawal rules in Alberta, it’s highly recommended that LIF holders seek professional advice from a financial advisor or pension expert. They can help navigate the rules and regulations and provide guidance on the best withdrawal strategy for individual circumstances.

What is the minimum annual payment from a LIF in Alberta?

+The minimum annual payment from a LIF in Alberta is determined by the LIF holder's age and the value of the LIF. The minimum payment is 4% of the LIF value for LIF holders between 55-60, 4.5% for those between 61-65, 5% for those between 66-70, and 5.5% for those 71 and over.

Can I withdraw a lump sum from my LIF in Alberta?

+In certain circumstances, LIF holders may be able to withdraw a lump sum from their LIF, subject to certain conditions and penalties. However, this should be carefully considered and discussed with a financial advisor to determine the best course of action.

In conclusion, understanding the LIF withdrawal rules in Alberta is essential for making informed decisions about your financial future. By considering the types of LIF withdrawals, tax implications, investment options, and income needs, LIF holders can develop a withdrawal strategy that meets their individual circumstances. Seeking professional advice from a financial advisor or pension expert can also help navigate the complexities of LIF withdrawal rules and ensure a sustainable income stream in retirement.