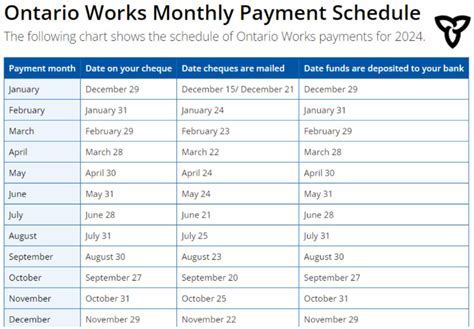

Ow Payment Dates

Understanding payment dates is crucial for individuals and businesses alike, as it directly impacts financial planning, budgeting, and cash flow management. Payment dates refer to the specific days when payments are due, whether it's for bills, loans, credit cards, or other financial obligations. In this article, we will delve into the world of payment dates, exploring their significance, types, and how they can be managed effectively.

Importance of Payment Dates

Payment dates are essential because they help individuals and businesses avoid late fees, penalties, and negative impacts on credit scores. Missing a payment date can lead to a cascade of financial issues, including increased interest rates, damaged credit history, and even legal actions. Furthermore, timely payments can help build a positive credit history, which is vital for securing loans, credit cards, and other financial services in the future. Establishing a reliable payment schedule is key to maintaining financial stability and avoiding unnecessary costs.

Types of Payment Dates

There are several types of payment dates, each with its own set of rules and implications. These include:

- Fixed payment dates: These are predetermined dates when payments are due, often monthly, quarterly, or annually.

- Variable payment dates: These dates can change from one period to another, often based on factors like income or expenses.

- Recurring payment dates: These are regular payments made at fixed intervals, such as subscription services or loan repayments.

| Payment Type | Frequency | Implications |

|---|---|---|

| Fixed | Monthly, Quarterly, Annually | Avoids late fees, builds credit |

| Variable | Based on income/expenses | Requires careful budgeting, can be risky |

| Recurring | Regular intervals | Convenient, but can lead to overspending |

Managing Payment Dates Effectively

Effective management of payment dates requires a combination of planning, discipline, and the use of appropriate tools. Creating a budget that accounts for all financial obligations, including payment dates, is the first step. This budget should be regularly reviewed and updated to reflect changes in income, expenses, or financial obligations. Additionally, calendar reminders and automatic payment setups can help ensure that payments are made on time.

Tools for Managing Payment Dates

Several tools and technologies are available to help individuals manage their payment dates more effectively. These include:

- Mobile banking apps that offer payment reminders and automatic transfer options.

- Personal finance software that can track expenses, create budgets, and set financial goals.

- Online calendar services that can send reminders for upcoming payment dates.

What are the consequences of missing a payment date?

+Missing a payment date can result in late fees, penalties, and a negative impact on credit scores. It can also lead to increased interest rates and, in severe cases, legal actions. Therefore, it's crucial to prioritize payment dates and make timely payments.

How can I ensure I never miss a payment date?

+To avoid missing payment dates, create a budget that includes all financial obligations, set up automatic payments, and use reminders. Regularly reviewing and updating your budget and payment schedules can also help ensure that you stay on track with your payments.

In conclusion, understanding and managing payment dates is a critical aspect of personal and business finance. By recognizing the importance of payment dates, understanding the different types, and leveraging tools and strategies for effective management, individuals can maintain financial stability, avoid unnecessary costs, and build a positive credit history. As financial landscapes continue to evolve, the significance of payment dates will only continue to grow, making it essential for everyone to stay informed and proactive in their financial planning.