Pierce The Corporate Veil

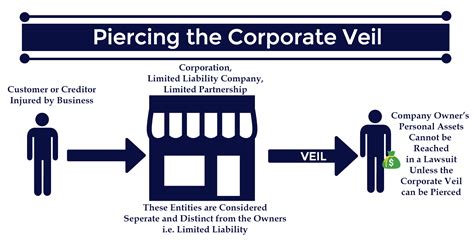

The concept of piercing the corporate veil is a legal doctrine that allows courts to disregard the separate legal personality of a corporation, and instead, hold its shareholders or directors personally liable for the company's actions. This doctrine is often applied in cases where a corporation is used to perpetrate a fraud, or to avoid liability for a debt or other obligation. In this article, we will explore the concept of piercing the corporate veil, its history, and its application in various jurisdictions.

History of Piercing the Corporate Veil

The concept of piercing the corporate veil has its roots in English common law, where it was first applied in the 19th century. The doctrine was initially used to prevent companies from avoiding their obligations by hiding behind their separate legal personality. Over time, the doctrine has evolved and has been adopted by many countries, including the United States, Canada, and Australia. Today, piercing the corporate veil is a widely recognized legal principle that is used to promote corporate accountability and prevent abuse of the corporate form.

When Can the Corporate Veil be Pierced?

The corporate veil can be pierced in a variety of situations, including where a corporation is used to perpetrate a fraud, or to avoid liability for a debt or other obligation. Courts may also pierce the corporate veil where a corporation is undercapitalized, or where its directors or shareholders have failed to maintain the formalities of corporate governance. In some jurisdictions, the corporate veil may also be pierced where a corporation is deemed to be an alter ego of its shareholder or director, meaning that the corporation is merely an extension of the individual’s personality.

| Country | Test for Piercing the Corporate Veil |

|---|---|

| United States | Alter ego theory, undercapitalization, and failure to maintain corporate formalities |

| Canada | Corporate veil can be pierced where a corporation is used to perpetrate a fraud, or to avoid liability for a debt or other obligation |

| Australia | Corporate veil can be pierced where a corporation is undercapitalized, or where its directors or shareholders have failed to maintain the formalities of corporate governance |

Application of Piercing the Corporate Veil

Piercing the corporate veil has significant implications for corporations and their shareholders or directors. Where the corporate veil is pierced, the shareholder or director may be held personally liable for the company’s debts or obligations. This can have serious consequences, including financial ruin and damage to reputation. In some cases, piercing the corporate veil may also lead to criminal liability, particularly where a corporation is used to perpetrate a fraud or other wrongdoing.

Defenses to Piercing the Corporate Veil

There are several defenses that may be available to a corporation or its shareholders or directors where a court seeks to pierce the corporate veil. These defenses may include the argument that the corporation was properly capitalized, or that its directors or shareholders maintained the formalities of corporate governance. In some cases, a corporation may also argue that it was not used to perpetrate a fraud, or to avoid liability for a debt or other obligation.

- Proper capitalization of the corporation

- Maintenance of corporate formalities

- Lack of wrongdoing or misconduct

- Absence of control by the shareholder or director

What is the purpose of piercing the corporate veil?

+The purpose of piercing the corporate veil is to prevent companies from avoiding their obligations by hiding behind their separate legal personality, and to promote corporate accountability and prevent abuse of the corporate form.

When can the corporate veil be pierced?

+The corporate veil can be pierced in a variety of situations, including where a corporation is used to perpetrate a fraud, or to avoid liability for a debt or other obligation. Courts may also pierce the corporate veil where a corporation is undercapitalized, or where its directors or shareholders have failed to maintain the formalities of corporate governance.

What are the defenses to piercing the corporate veil?

+There are several defenses that may be available to a corporation or its shareholders or directors where a court seeks to pierce the corporate veil. These defenses may include the argument that the corporation was properly capitalized, or that its directors or shareholders maintained the formalities of corporate governance.