W9 Form Pdf

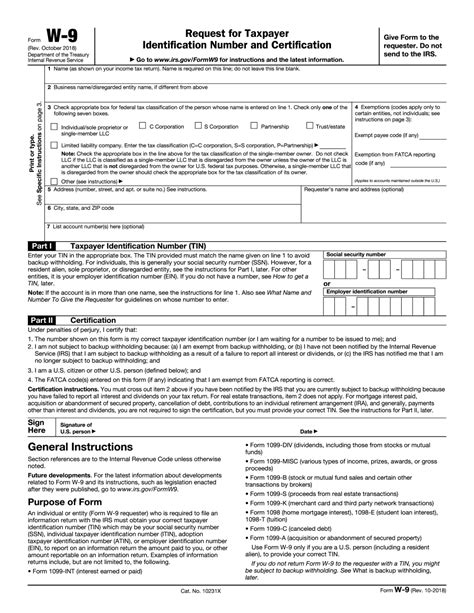

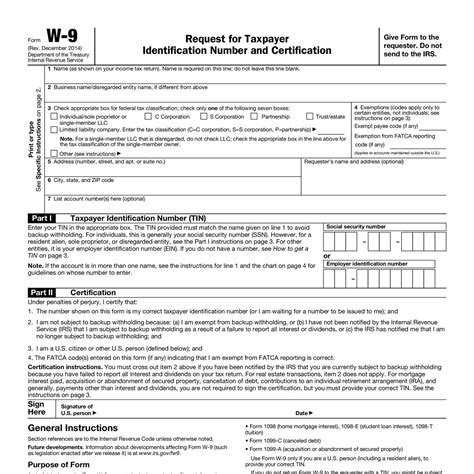

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a crucial document used in the United States for tax purposes. It is typically provided by independent contractors, freelancers, and other self-employed individuals to their clients. The W-9 form pdf is readily available from the Internal Revenue Service (IRS) website and serves as a means for these individuals to provide their correct taxpayer identification number (TIN) to payers, who will use this information to prepare and file various tax information returns.

Understanding the W-9 Form

The W-9 form is essential for businesses and individuals who need to report income paid to non-employees, such as independent contractors. The form asks for the taxpayer’s name, business name (if different), business entity type (e.g., individual, corporation, partnership), address, and taxpayer identification number (either a Social Security number for individuals or an Employer Identification Number for businesses). The form also includes a certification section where the taxpayer certifies under penalties of perjury that the information provided is correct and that they are not subject to backup withholding.

Purpose of the W-9 Form

The primary purpose of the W-9 form is to provide the payer with the correct taxpayer identification number and to certify the taxpayer’s identity. This information is necessary for the payer to accurately report income paid to the taxpayer on information returns such as the Form 1099-MISC. The IRS uses the information from these forms to match against the taxpayer’s tax return to ensure that all income is reported and that taxes are correctly paid.

| Information Required | Description |

|---|---|

| Name | The taxpayer's name as it appears on their tax return. |

| Business Name | The name of the business, if different from the taxpayer's name. |

| Business Entity Type | The type of business entity (e.g., individual, sole proprietor, corporation, partnership). |

| Address | The taxpayer's address. |

| taxpayer Identification Number | Either a Social Security number (SSN) or an Employer Identification Number (EIN), depending on the business entity type. |

Obtaining and Completing the W-9 Form

The W-9 form can be downloaded from the IRS website in pdf format. Once downloaded, the form can be completed electronically and then printed, or it can be printed and completed by hand. It is essential to follow the instructions provided by the IRS for completing the form accurately. Incorrect or incomplete information can lead to delays or penalties.

Instructions for Completion

The instructions for completing the W-9 form are as follows: - Enter the taxpayer’s name as shown on their tax return. - If the business name is different from the taxpayer’s name, enter it in the space provided. - Select the appropriate box to indicate the type of business entity. - Provide the taxpayer’s address. - Enter the taxpayer’s Social Security number or Employer Identification Number. - Sign and date the form.

The completed form should then be returned to the payer, who will use the information provided to prepare the necessary tax information returns.

What is the purpose of the W-9 form?

+The W-9 form is used to provide the payer with the taxpayer’s correct name and taxpayer identification number, which is necessary for reporting income paid to the taxpayer on information returns.

Who needs to complete a W-9 form?

+Independent contractors, freelancers, and other self-employed individuals who receive income subject to reporting on Form 1099-MISC need to complete a W-9 form for each payer.

Where can I download the W-9 form?

+The W-9 form can be downloaded from the Internal Revenue Service (IRS) website in pdf format.