What Is Alberta Non Group Coverage? Insurance Options

Alberta non-group coverage refers to health insurance options available to individuals and families who are not covered under a group insurance plan, typically offered by an employer. In Alberta, Canada, residents have access to a publicly funded healthcare system, but there are still gaps in coverage for certain services and expenses. Non-group coverage is designed to fill these gaps and provide additional protection for individuals and families who need it.

Overview of Alberta Non-Group Coverage

In Alberta, non-group coverage is available through private insurance companies, and it can be purchased by individuals, families, or self-employed individuals. This type of coverage is also known as individual or family health insurance. Non-group coverage can provide additional benefits, such as prescription drug coverage, dental care, vision care, and travel insurance, which may not be covered under the public healthcare system.

Types of Non-Group Coverage

There are several types of non-group coverage available in Alberta, including:

- Individual health insurance: This type of coverage is designed for individuals who are not covered under a group plan. It can provide additional benefits, such as prescription drug coverage and dental care.

- Family health insurance: This type of coverage is designed for families who are not covered under a group plan. It can provide additional benefits, such as prescription drug coverage, dental care, and vision care.

- Self-employed health insurance: This type of coverage is designed for self-employed individuals who are not covered under a group plan. It can provide additional benefits, such as prescription drug coverage and dental care.

| Insurance Provider | Plan Options | Premium Range |

|---|---|---|

| Manulife | Individual and family plans | $50-$500 per month |

| Sun Life | Individual and family plans | $75-$750 per month |

| Great-West Life | Individual and family plans | $100-$1,000 per month |

Benefits of Non-Group Coverage

Non-group coverage can provide several benefits, including:

- Additional protection: Non-group coverage can provide additional benefits, such as prescription drug coverage, dental care, and vision care, which may not be covered under the public healthcare system.

- Flexibility: Non-group coverage plans can be tailored to meet individual or family needs, providing more flexibility than group plans.

- Portability: Non-group coverage plans are portable, meaning that you can take them with you if you change jobs or move to a different province.

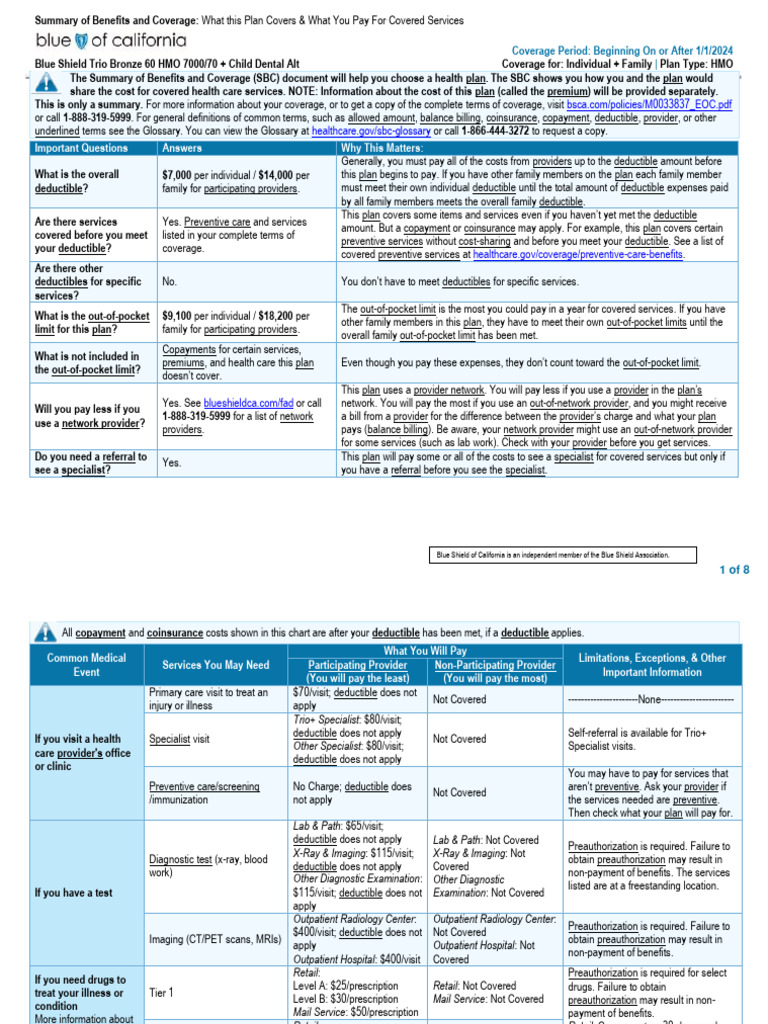

Cost of Non-Group Coverage

The cost of non-group coverage can vary depending on several factors, including:

- Age: Premiums may increase with age.

- Health status: Pre-existing medical conditions may affect premium costs.

- Coverage options: The level of coverage and benefits chosen can impact premium costs.

It's essential to carefully review and compare premium costs and coverage options from different insurance providers to find the best plan for your needs and budget.

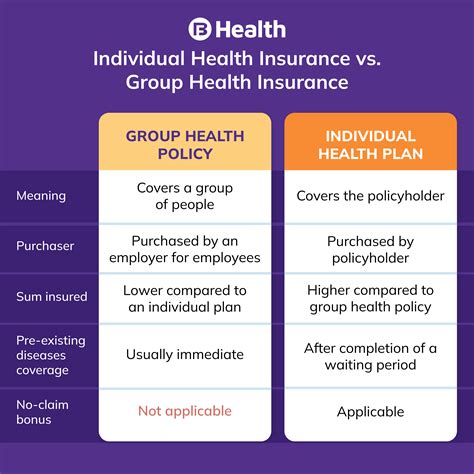

What is the difference between group and non-group coverage?

+Group coverage is typically offered through an employer, while non-group coverage is purchased individually or by families. Non-group coverage can provide more flexibility and portability than group plans.

Can I purchase non-group coverage if I have a pre-existing medical condition?

+Yes, you can purchase non-group coverage with a pre-existing medical condition, but it may affect your premium costs. It's essential to disclose your medical condition to the insurance provider to ensure you receive the right level of coverage.

In conclusion, Alberta non-group coverage provides individuals and families with additional protection and flexibility beyond the public healthcare system. By carefully reviewing and comparing premium costs and coverage options, you can find the best plan for your needs and budget.