What Is Arizona Sales Tax? Easy Calculation Guide

Arizona sales tax is a consumption tax imposed by the state of Arizona on the sale of tangible personal property and certain services. The tax is administered by the Arizona Department of Revenue and is used to fund various state and local government programs. In this article, we will provide an easy calculation guide to help you understand how Arizona sales tax works and how to calculate it.

Arizona Sales Tax Rates

The state of Arizona imposes a statewide sales tax rate of 5.6%. However, this rate can vary depending on the location within the state. Local governments, such as counties and cities, can also impose their own sales tax rates, which are added to the state rate. The combined state and local sales tax rate in Arizona can range from 5.6% to 11.2%, depending on the location.

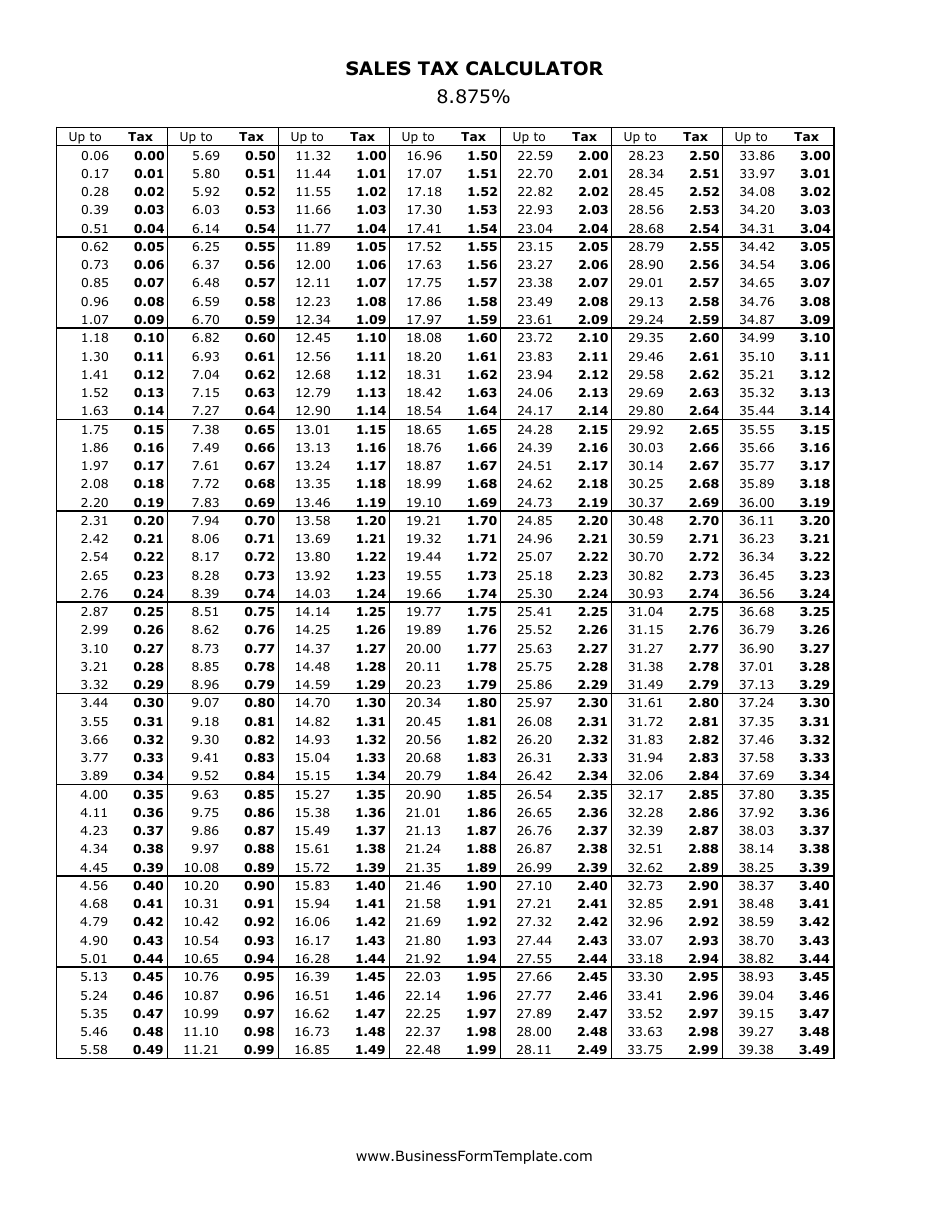

Calculating Arizona Sales Tax

Calculating Arizona sales tax is relatively straightforward. To calculate the sales tax, you need to know the purchase price of the item or service and the applicable sales tax rate. The formula for calculating sales tax is:

Sales Tax = Purchase Price x Sales Tax Rate

For example, if you purchase an item for $100 and the applicable sales tax rate is 8.1% (5.6% state rate + 2.5% local rate), the sales tax would be:

Sales Tax = $100 x 0.081 = $8.10

The total cost of the item, including sales tax, would be:

Total Cost = Purchase Price + Sales Tax = $100 + $8.10 = $108.10

| Location | State Sales Tax Rate | Local Sales Tax Rate | Combined Sales Tax Rate |

|---|---|---|---|

| Phoenix | 5.6% | 2.3% | 7.9% |

| Tucson | 5.6% | 2.0% | 7.6% |

| Flagstaff | 5.6% | 2.5% | 8.1% |

Arizona Sales Tax Exemptions

As mentioned earlier, some items and services are exempt from Arizona sales tax. These exemptions include:

- Groceries

- Prescription medications

- Certain medical services

- Non-profit organizations

- Certain types of manufacturers

Arizona Sales Tax Holidays

Arizona does not currently offer any sales tax holidays. However, the state has offered sales tax holidays in the past, typically for back-to-school items and energy-efficient appliances. It’s essential to check with the Arizona Department of Revenue for any upcoming sales tax holidays.

What is the Arizona state sales tax rate?

+

The Arizona state sales tax rate is 5.6%.

Do local governments in Arizona impose their own sales tax rates?

+

Yes, local governments in Arizona, such as counties and cities, can impose their own sales tax rates, which are added to the state rate.

Are there any exemptions from Arizona sales tax?

+

Yes, some items and services are exempt from Arizona sales tax, such as groceries, prescription medications, and certain medical services.